Programming note: I know I skipped a day, I am sorry. I promise I will get back to it when I have the chance!

Investors have two goals. The first of them is to generate returns. Returns, however, are often unimpressive in a vacuum. Just because a company makes a lot of money does not make it a particularly exceptional company, it just makes it a company that makes a lot of money, which is good, but not always interesting for the enterprising investor. They are interested in the excess returns that some companies can make, and their ability to grow faster than the companies around them or the economy as a whole. Not all companies can do this, and predicting which companies can is immensely hard. The second goal is to minimize risk. Returns are only good if they stick around — if you invest in some risky venture, and it makes a ton of money for 6 months then goes kaput, all of the value of your investment has gone into the ground.

The first of these goals is called alpha, as in seekingalpha.com, the finance website, or FT's Alphaville, the financial commentary blog. The second is called beta, the measure of the relative volatility of an asset compared to the overall market.

Finding alpha in normal and moral ways or through hard work is very challenging. Finding arbitrage opportunities lets you create alpha by simply being clever and witty, and can make you a ton of money. In the case that the arbitrage opportunity you have found is illegal, then some enforcement organization (DOJ, IRS, SEC, etc) may come after you, but you can just hope that they give you a light slap on the wrist, or that they don't punish you at all. Arbitrage is not inherently amoral, but to many, it sounds like you are taking advantage. Arbitrage fans brush off these critiques by saying that they are simply correct market inefficiencies and that their actions actually benefit the general public.

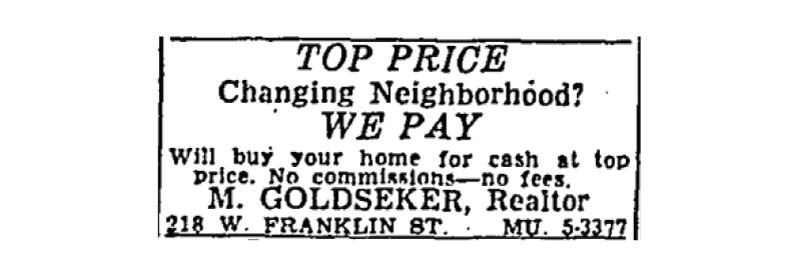

Today, I learned about perhaps the most ingenious and simultaneously amoral arbitrage opportunity in the form of blockbusting. In brief, real estate agents lied to residents of white neighborhoods by claiming that black (or other minority) people were moving in. Fearing the adverse effects of integration and the subsequent economic punishments that it came with, the white residents felt the need to sell their property immediately, egged on by real estate agents claiming to act in their white counterparts' best interest. Affiliates of the agents then bought the properties at deeply discounted prices, and sold them to actual middle-class Black people at above-market prices.

This was all possible because of the context of the time. Racially restrictive covenants were no longer enforceable, eliminating a favorite method of racists to keep undesirable people out of their neighborhood. The second great migration brought millions of Black people from the south to the north, causing extremely tight housing markets because of slow housing growth during World War II. Black people could now become more affluent because of access to higher-paying Northern jobs, and were now interested in buying more expensive housing.

|

| Source: A.S. Abell Company, 1958, Sun, September 26, p. 36. |

Blockbusters were ruthless. They hired Black people to come walk around white neighborhoods. This wasn't some limited phenomenon either, this was widespread. Blockbusters charged an average of a 45% markup on these houses they sold to Black people.

Blockbusting was essentially taking advantage of racial animus for financial gain, and for that, makes its mark as one of the most ingenious forms of arbitrage and financial racism that exist in history. For those same reasons, it also made its mark as an influence on segregation and urban inequality in the United States. Congratulations, blockbusters. I guess you made money.